CBAM in the EU

European Union Carbon Border Adjustment Mechanism

The EU’s CBAM is a carbon price on certain imported goods, including aluminium and steel packaging. Importers must now report on carbon emissions and purchase CBAM certificates to cover the associated carbon cost. Accurate data is essential to avoid border delays, compliance risks and unexpected financial exposure.

How CarbonQuota can help

Our platform and team of expert consultants can assist at all stages of the CBAM compliance process for aluminium and steel packaging, through:

- Clear guidance to help you identify and collect the right data from suppliers

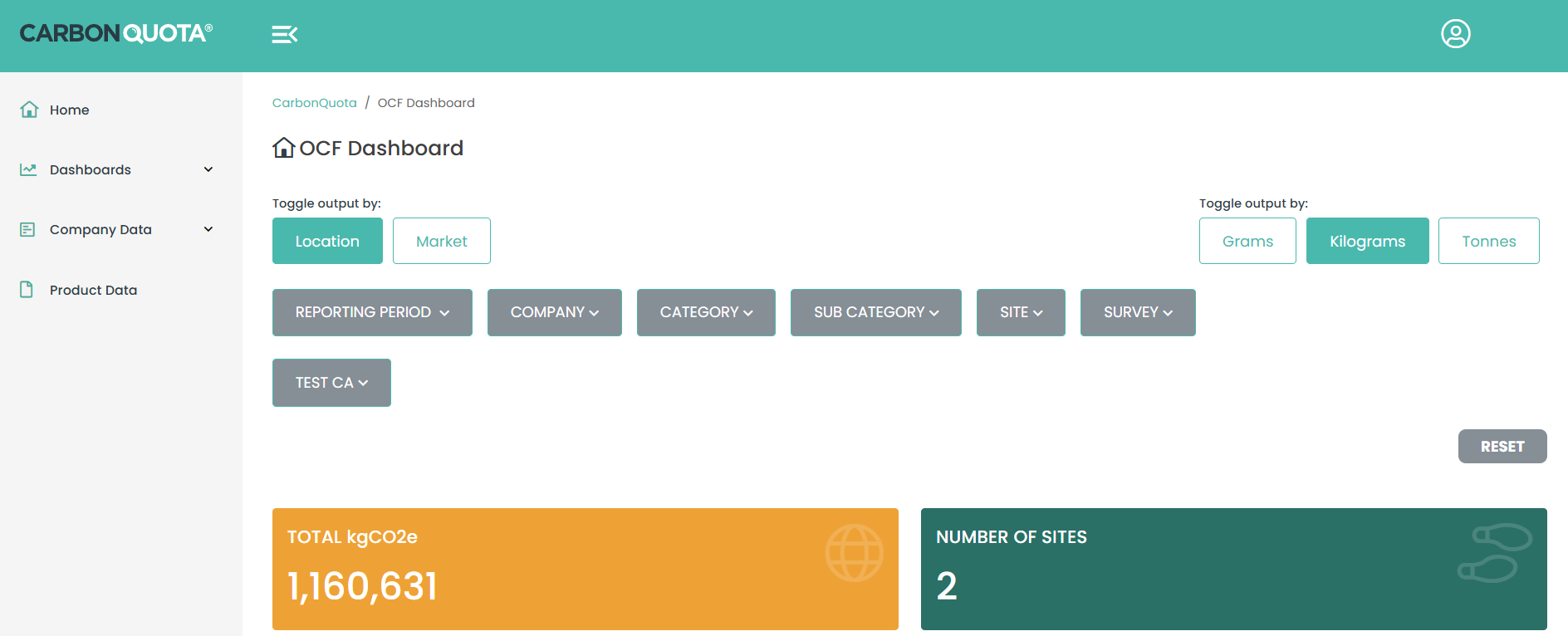

- Online portal for compliant emissions data management

- Calculation of carbon emissions for aluminium and steel packaging

- Strictly defined processes and tools aligned with EU CBAM requirements

- Summarised tables and supporting text for quarterly reports

- Guidance and support from your dedicated Environmental Science Consultant

- Assurance by an independent expert for accuracy and credibility

- Results prepared in a format ready for customs and CBAM certificate submissions

- Documentation that is audit-ready for EU authorities

Find out how we can support your business

Will you be affected?

CBAM applies if you import more than 50 tonnes of aluminium and/or steel packaging into the EU. You must:

Report embedded carbon emissions for aluminium and steel packaging imports

Submit compliance reports to EU authorities

Purchase certificates by May 2027 for 2026 activity

Establish supplier-level carbon emissions, all the way back to the primary smelting

What to report on:

Embedded emissions from aluminium and steel production and processing

Product lifecycle carbon data

Supplier-level emissions data for transparency and verification